Taking out a mortgage is the largest financial commitment that most Australians will make in their lifetime. If you invest in a property you could be making repayments for the next 30 years. This article will focus on a number of tips that can help you save interest on your mortgage and pay off the debt on your home at a faster rate.

1. Pay large sums into your loan

Rather than spending any large lump sums you receive, pay them straight into your loan. Think of larger windfalls as an excellent opportunity to reduce the overall interest on your loan and therefore the overall cost of your mortgage. Unexpected windfalls can include:

- Tax refunds

- Inheritance

- Annual bonus

- Insurance payout

- Cash gifts

2. Make small budget adjustments to make small additional payments

If your budget allows, make more than the minimum mortgage repayment your lender requires. The extra $10 or $20 may not seem like much at the time but the magic of compound interest means that these small extra repayments will make a difference to the term of your loan and how much interest you pay.

It’s a common cliché, but simply making your morning coffee at home rather than buying from a cafe can save you close to $100 per month. Common ways to reduce your daily expenditure include:

- Making a coffee at home instead of buying from a cafe

- Meal prepping for the week (saving meals out for special occasions)

- Shop for quality – avoid fast fashion

- Cancel unnecessary subscriptions

- Buy household goods in bulk

3. Pay your mortgage fortnightly or weekly

By default, the majority of mortgages will be repaid on a monthly basis. However, many lenders will allow you to make fortnightly or even weekly payments. Some lenders will debit half of your monthly repayments on a fortnightly basis, this is called accelerated repayments. This means you end up paying more per year on your mortgage, as there are 26 fortnights and 12 months in a year, which saves you interest and means you pay off your debt faster.

Bear in mind, some lenders are wise to this and calculate the fortnightly repayment to equal the amount you’d pay in a year if you paid monthly. In this case, you would not save any money on the overall interest paid. However, because interest is calculated daily you would still derive some benefit from making these early repayments.

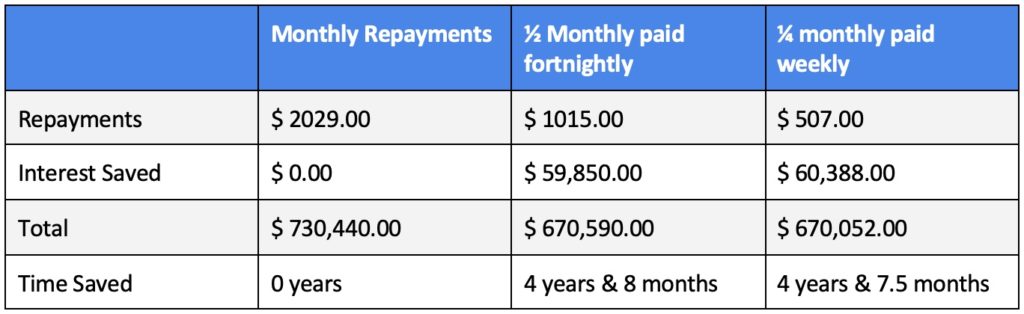

See the example below for how accelerated fortnightly/weekly payments could save you money.

Example:

Chris and Anne are paying back a $400,000 loan with an interest rate of 4.5%. The loan term is 30 years. If they pay their loan monthly they will pay $2029.00 per month, which means the total repayment on the loan is $730,440.00.

However, assuming the interest rate stays the same for the entire term, if Chris and Anne make repayments of $1015.00 (half the monthly amount) every two weeks, they will save $59,850.00 in interest and the total loan repayments will be $670,590.00. The couple will save even more interest if they make repayments weekly, as the interest on the loan is calculated daily.

4. Take advantage of redraw facilities

Making extra repayments on your mortgage is a great idea. With regular additional payments you can save large amounts of interest on your loan. However, once that money is paid into your mortgage you no longer have access to it as a liquid asset.

If life throws you an expensive curveball (think problems with the boiler, broken refrigerator, etc.) you may need to draw some of that money out of the mortgage to cover costs. This is where a redraw facility comes into play.

A redraw account is like a bank account associated with a mortgage that allows you to make additional repayments. However, if you do need to withdraw the money at any point you can. One problem with redraw accounts is that they are not really bank accounts, rather they are facilities associated with your home loan. This means that you cannot access the money as easily as a regular bank account.

5. Use offset accounts

An offset account is simply your day to day bank account but with one difference: it is connected to your mortgage and any funds in there offset funds owing on the mortgage for that day. If, for example, you have $5000 in the offset account you won’t pay interest on $5000 of your mortgage for that day. If the balance drops to $3000 the next day, you won’t pay interest on $3000 that day and so on.

There are no restrictions to the amount you can withdraw from the offset as it is an entirely separate facility to the home loan. It is a regular, day to day transaction account that enables instant access to any and all of your funds via ATMs, Eftpos, internet banking, etc. Offset works similarly to redraw, funds in the offset account cancel out funds owing on the mortgage, but the essential difference is offset does this without the need to physically transfer funds into the loan.

6. Link a credit card to your offset account

This isn’t for everyone, but some clients are also using the interest free days on a linked credit card, leaving their wages to accumulate in the offset account for as long as they can. This way they get to use the banks money for their spending while their own money saves mortgage interest. Because they are not paying as much interest, more of their monthly payment is coming off the amount they owe. Rewards points can also accrue on the credit card. However, I issue a word of warning here, this method only works for those who budget carefully. The credit card can be a loaded gun otherwise!

I typically recommend starting slowly by shelving the credit card during the first year of home ownership to adjust to the new expenses that come along. A simple method of saving interest during this time is to withdraw only the cash you need from the ATM. If you only need $40, take just that. If you take $100 just in case, you’re suddenly paying daily interest on the $60 that is sitting in your pocket.

In most cases though, to get a good interest rate, offset loans come with a hefty annual fee, some as high as $400 per year. For this fee you are usually offered a fee free bank account and a credit card with no annual fee. I estimate these would equate to $200 per year, which means you are still paying $200 per year just to have an offset account. On a $500k mortgage, $200 is the equivalent of 0.04 approx on top of the interest rate.

—

Written by Marc Barlow of Mortgage Broker Melbourne

Marc Barlow is the principal at Mortgage Broker Melbourne and has been a professional lender for 28 years. After beginning his career in 1990 with a UK Building Society, he moved to Australia where he held several different retail banking roles. In 1999 it became clear to him that a mortgage broker would eventually become an obvious choice for someone looking for a home loan so he took the plunge and became an independent broker. He hasn’t looked back since!