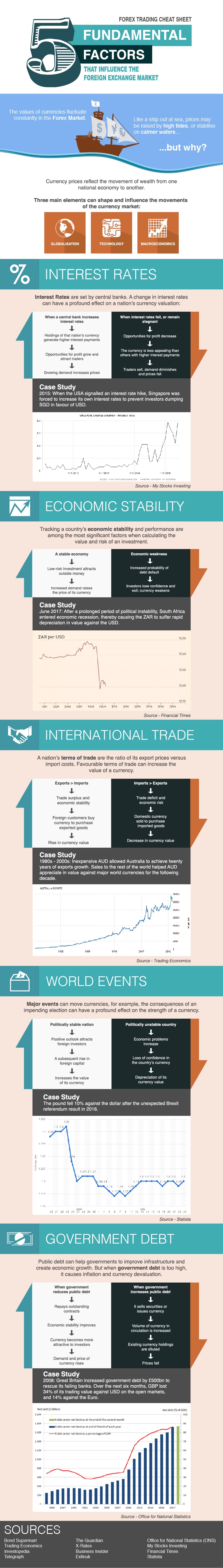

What makes the prices of currencies move on the open market? This is one of the first questions that virtually every trader tries to answer. The reality is that values fluctuate constantly in the currency markets and, more often than not, they are at the mercy of the countless trends and influences found throughout society.

Factors that Influence

Geopolitical turbulence, macroeconomic policy, government legislation, and technological breakthroughs all rank among the most influential world events on forex prices. Events which affect the forex market can be as benign as a democratic election which returns the predicted outcome, or as unpredictable as the outbreak of a war, or a natural disaster.

Trading the News

Each participant in the currency market is constantly anticipating price movements. To accomplish this, traders rely on news reports and market data to inform their positions. This is one reason why veteran traders will spend as much time scanning live news feeds as they do watching the currency charts. It is called “trading the news”.

As geopolitical factors change, they create movements in the market: encouraging a seller to raise their prices, or convincing a buyer to lower their offer in response to a growing risk. Learning how to best interpret the news and apply that knowledge to investment decisions is, therefore, a vital technique for every forex trader.