The automotive market’s performance is not closely related to personal finance, unless you’re planning to buy a car or work in this industry. My article tries to summarise the latest statistical repots.

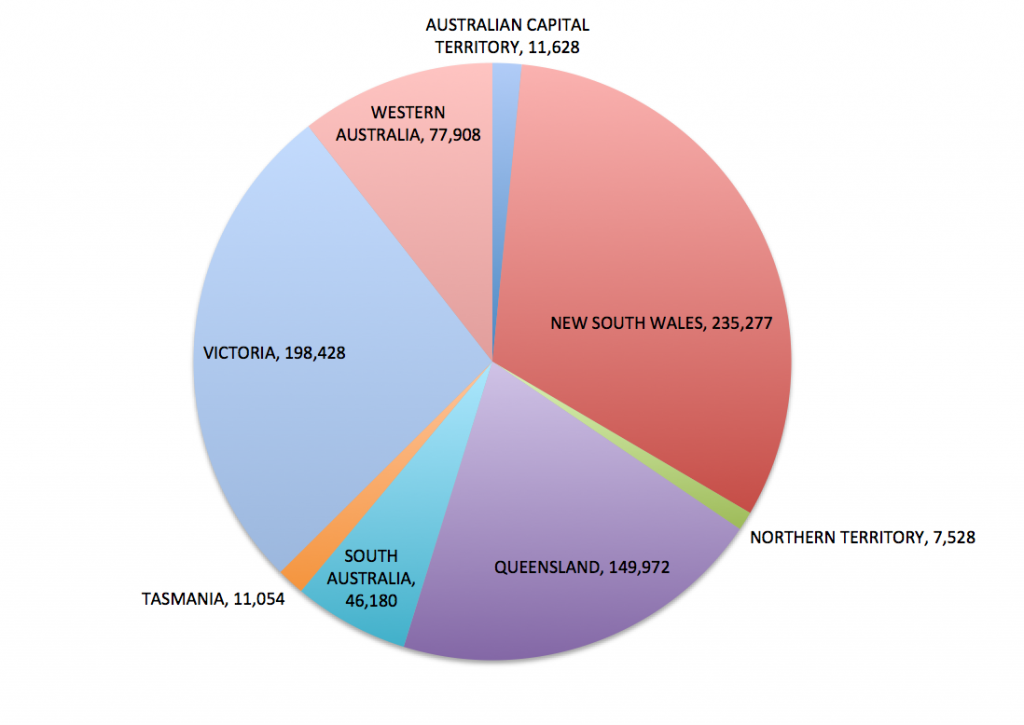

Based on the monthly and yearly comparison reports of the Federal Chamber of Automotive Industries (FCAI), car dealers are having a tough time in Australia, especially in WA. The national year-to-date (YTD) average declines in vehicle sales was -2.5% in August 2014. Western Australia is leading this negative list with -8.3%, followed by Tasmania and Queensland with -7.1% and -5.4%, respectively.

The report doesn’t have state specific statistics about vehicle types, but in overall “passenger” vehicle sales decreased by 5.4% year-to-date, as well as light and heavy commercial vehicle sales. The only growth was reported in the SUV market, +3.7% year-to-date. The FCAI report has more details about the passenger type vehicles. Micro, light, small and medium categories decreased, while large, upper large and people movers increased YTD. The sports category had a 7.8% decrease.

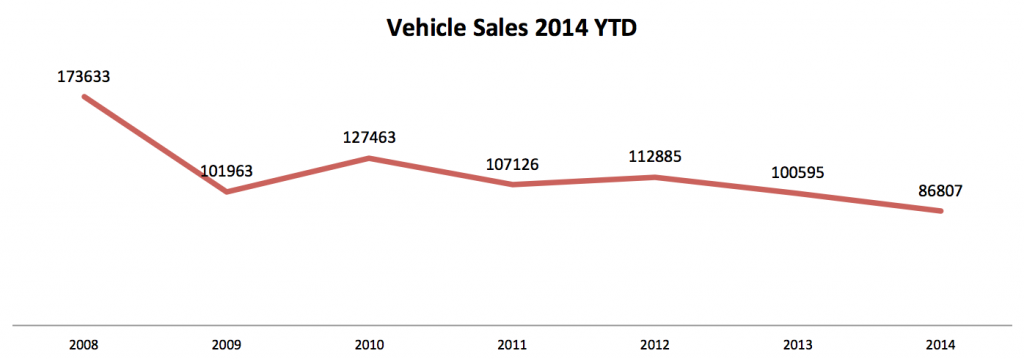

In the SUV market, small SUVs had the best and only positive performance (+15.7%); therefore, the SUV market increased mentioned in the previous paragraph is due to the small ones. In overall, it’s not looking too good and it’s interesting to compare these numbers with the Australian automotive industry’s monthly product volumes. The FCAI website has data about the monthly production volumes and it can be seen that 14% less vehicles were built during the first two quarters of 2014 than the previous year. The product volume has been decreasing since 2013.

The tough market situation might be good if you’re planning to buy a car, because you have a better chance to get a larger than average discount from car dealers. As far as I know, car dealers make profit on service, not car sales, so you should compare prices and fight for a good discount.