Apart from buying a house, superannuation is likely to be one of the biggest investments that you will make in your lifetime. Understanding your options and making the right decision can make the difference between scraping by or having that well-deserved, worry-free retirement.

In 2005, new legislation was introduced that put the power of super firmly in the consumer’s hands and gave many Australians like yourself the power to choose which fund your contributions would be made into.

With that new power came the problem of choice. With many superannuation funds and thousands of investments options to choose from, how do you know which is best for you?

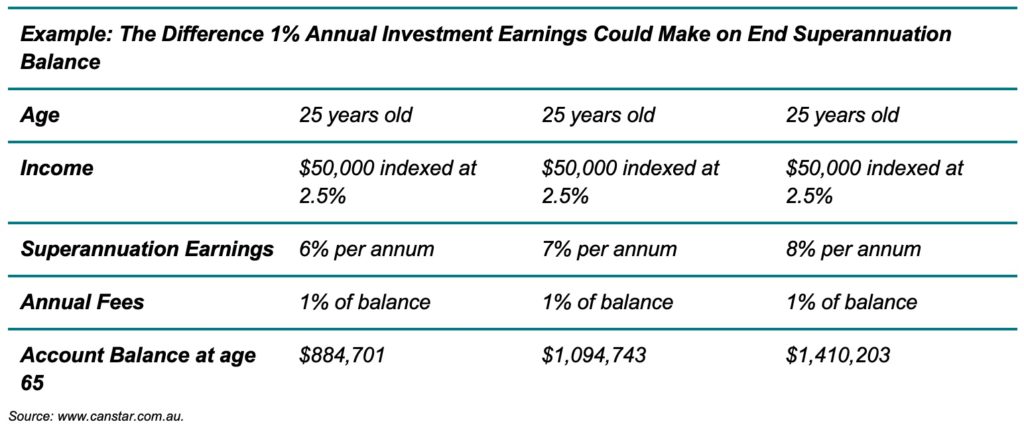

We asked Ian Potter, Senior Financial Adviser, at Superannuation Advice Australia for his advice on what to look for when choosing a super fund. “There are some key factors you should consider before making your decision. These include checking that the fund is supported by your employer, investment fees and options, insurances and the past performance of the fund. Even a small difference in performance can add tens of thousands of dollars to your super balance.”

In fact, just a 1% difference in average super performance can really add up over the years:

With such small differences making a big impact, it’s vital to stay on top of your super.

How does your fund compare and what are you on track for at retirement age? If you don’t know the answer to these questions, it’s worth doing some research.

Well respected and forward-thinking firms like Superannuation Advice Australia provide a no-obligation review service which will show you what you’re on track for at retirement age and recommendations on what can be improved.

Alternatively, every super fund will have Product Disclosure Statements with more information about the fund. Rating agencies like Morningstar will allow you to compare the performance of different super funds.

Whichever method you choose, here are the basics you need to consider:

Contributions:

Make sure you look at the fund offered by your employer as they may offer to pay more than the minimum 9.5% contribution if you do. If that’s the case, make sure you check the details to see if it’s right for you. If you decide to choose your own fund, make sure it accepts contributions from your employer as some funds can be restricted.

Fees

All super funds charge fees and over the full term of your investment these fees can stack up. Every dollar paid is a dollar less for your retirement. Look for a fund that charges a low fee for their services. A 1% difference in fees now could be up to a 20% difference over a 30 year period.

Investment Options

Look at the investment options offered to see if there’s an option suitable to your life-stage and openness to risk. A higher risk option could perform better over the long term but this isn’t guaranteed, whereas a lower risk strategy is less likely to experience periods of volatility but you should expect your overall returns to be lower.

Past Performance

Super investment is for the long term so when considering a fund, make sure you look at the longer-term performance of the particular fund. It’s important to understand that whilst a fund can perform well one year, it isn’t guaranteed to the next so take a look at trends over a five-year period to get a broader view of performance.

Insurances

Does the super provider offer insurances? The range of benefits offered can vary so make sure you understand what’s on offer and what you’ll get.

Your super is for life so make sure you give it the time it deserves to maximise your retirement.