Every day countries publish economic reports, meetings of Central Banks are held, as well as governors give speeches. These events usually occur at a scheduled time. To keep abreast of the upcoming events traders use an economic calendar where the time of their release and the degree of importance are displayed.

An important economic event can significantly change the market price of the asset in a matter of minutes. Traders respond to news reports in different ways. Some traders expect such news and recommend not to miss the opportunity to benefit, while others stop trading before the releases and wait for the market to calm down.

News traders try to predict the movement direction and the possible market response and place orders before publication in the direction the price is supposed to move. This approach brings maximum profit if the price movement matches the forecast. However, such a trading is risky.

How to read economic Forex calendar

The currency pair consists of two currencies. Each pair represents the market sentiment of two countries, the currencies of which are presented in this currency pair. For example, if we trade the EUR/USD currency pair, then we will be interested in economic events taking place in the Eurozone and the US.

The economic calendar is available free of charge on analytical resources and websites of forex brokers, including the official JustForex website.

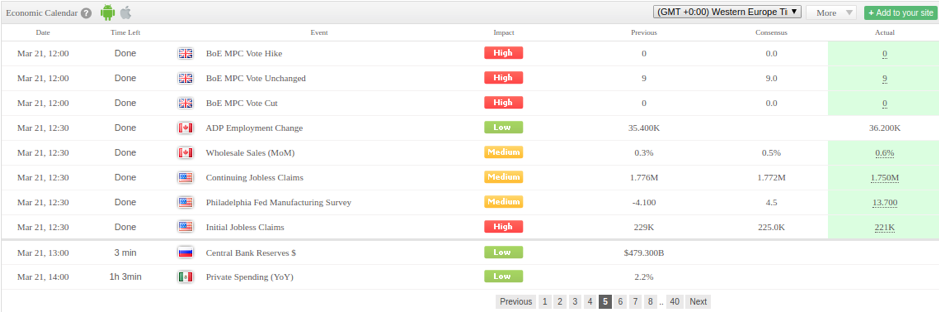

What economic calendar columns mean:

- – indicates the date and time of the release.

- – displays how much time remains until the beginning.

- – contains the name of the upcoming event.

- – reflects the degree of importance of the event, measured by low, medium, high.

- – displays the previous value.

- – contains the forecasted value, what result analysts expect.

- – indicates the actual value at the time of their release.

Let’s consider the example of how to read economic calendar using figures of initial jobless claims.

The news will be published at 12:30, it will affect the US dollar and show the number of initial jobless claims. The previous figure was 229K. Analysts forecast that the figure will be 225.0K.

The actual figure has counted to 221K, which is lower than expected. The decrease of initial jobless claims indicates an improvement in the labor market and contributes to the growth of the dollar. The positive news is highlighted in green.

The impact of Forex news

News marked with Medium and High may significantly affect price movement. Such news can cause a sharp rise in price or make it fall. The following news influence the market the most:

- change in key interest rates;

- employment and unemployment changes;

- inflation data;

- consumer price indices;

- economic growth of the country.

Regardless of whether the released information is bad or good, it creates additional volatility in the market. Forex market news drives the market. Good news creates an increased demand for an asset. It is believed that most of significant short-term fluctuations in the market occur on the news. At the same time, it helps traders to take decisions for successful trading at their forex broker (for instance, JustForex). The economic calendar contains everything the trader needs for fundamental analysis. It will also be useful for traders who avoid news price fluctuations to determine the time of the greatest volatility.